Last Updated on 2020-05-07 by Tom

What does “20/80 Rule” truly mean in Real Estate?

We all hear “20/80 Rule”often. It loosely means a small portion among a defined group (~20%) contribute (or take) the total results that the rest of 80% can do combined. I often wonder if this rule also applies to the residential real estate field. After many years in it, my answer is a resounding “YES”! In this post, I will share with you the why, what, and how.

Firstly, the”Why” – there are many ways to invest in real estate. In general, they all can be set to one of the following two categories (or the combination):

- Take on the lucky rides of asset appreciation – meaning to expect the great property appreciation in a short time so that one can make a great profit via flipping.

- Choose carefully on both property and tenants then let this investment grow in a self-sustained way for years to come – and bring endless cash flow year after year….

Personally, I am a big believer of the second type. I like to describe it as planting an apple tree, with the aiming to have endless apples when the tree matures and gives back. In reality, I try to be as lazy as possible physically – pick up a right tree, a right place, at the right time, dig a hole, plant the tree, hire a right gardener to take care the tree – till the endless apples rolling in… And here is why this approach is actually solid and likely to win – it is all based on the so called principle of empirical value “68/95/99.7%” .

the three numbers of “68/95/99.7%” are derived from the basic statistic analysis concept of mean value and standard deviation. Before we all get dizzy and lost in the math jargon, let’s use the real life example to demonstrate what is really going on.

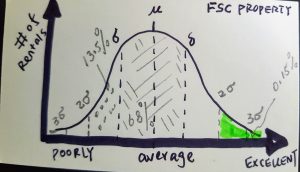

Let’s say we have 100 rental properties to choose from to get the final winner. For simplicity, we category these properties along the range of “poorly – meaning it unlikely to give back any apple”, average – meaning it is OK, but a bit lame on the amount of the apples growing each year, and taste not that great either…” to all the way we call it Excellent – meaning it is likely a beautiful apple tree, no need to do anything, but growing endless apples with great taste” . In addition, these properties are distributed normally (except the Donald Trump Tower, or Joe Baden’s basement). To put these properties in the same picture, it would be something like this (See diagram below)

Here is how – Based on the so called empirical principle (it has been approved by much smarter people than me, many many years ago, I decide to trust them instead to re-invent the wheel myself :)), we would have 68 houses among the 100 can be simply regarded as so called “average” or “mediocre”, and in the rest of 32 houses, there will be 13.5 are even worse, and 13.5% are better in terms of the long-term performance. If you add them all together, you will have 95 houses in total already. Going even further, there will be 2.25 houses are even worse, and 2.5 house are way better, which left the rest of the house of 0.5 to be split even further….

Now comes what – we can learn from this simple drawing? Two things right off the bat:

- One wise investor must keep away from the above “average” zone and anything towards the left. What is the percentage of them? surprisingly, with a simple math that we should all be able to do, it is a total of “85%” or “85 houses in this example, are simply ‘garbage’ and yes it is roughly what we called “20/80 rule” play invisibly.

- Even more importantly, you need to truly focus on the “green zone” shown in the “quick and dirty drawing” above, nothing else should steer you away from that laser focus – not your wife, not the newly coming to town experts, definitely not the realtors who are simply trying to sell the damn listing for months with the price keep going down….

Now let’s turn to another important piece of puzzles – What about the tenants?

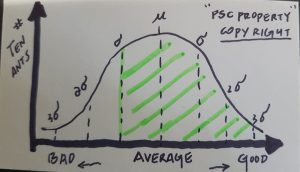

To keep it simple, lets say we have 100 tenants to choose from for the ideal one to fit into your investment – I hope you can see where I am going… Yes, the same principle applies in a bit twisted way shown in the drawing below:

This is the other half of the total secret of the long term successful real estate investor – yes, stay in the green zone and keep away from the bad zone on the left (if you like to play the numbers, you will be amazed to see once more it is about 20% of the total, which you should try to avoid to get into your rentals. Yes, it is the invisible 20/80 rule again). And in the tenant screening game, the rule is lot more forgivable than choosing the property – As long as you are decent to pick up around 80% of decent clients from the the market, you will be doing just fine. In other words, to water and nurture your “apple tree”, any water will do, just don’t use poison, that is the key.

Here you have it – 20/80 rule is fundamentally important in the strategy of long term residential real estate investment. it has been attested by strict mathematical principle of “68/95/99.7%” and revealed the simple but powerful truth –

One actually can plan the success – the true success is never accidental. It governs by the invisible natural force, to be a master, all you need is to let the force be with you.